Equip your organization to face risks head-on. A risk management framework helps you navigate, mitigate, and respond to any and every hazard that comes your way.

Quick Guide to Risk Management Frameworks

As a security leader, you constantly fight battles—from cyber attacks to extreme weather to internal misconduct. While the threats are all over the place, your management strategy shouldn’t be. The game plan is always the same: identify, assess, act, repeat.

Rather than creating custom solutions for every threat, you need a systematic approach that works across all hazards and risks. That’s where a risk management framework comes in.

In this article, we’ll explore what risk management frameworks are, your implementation options, and why they’re critical to your organization’s security posture.

Download Our Risk Mitigation Plan Template

What Is a Risk Management Framework?

A risk management framework (RMF) is a structured approach organizations use to manage risk. RMFs establish standardized procedures for making informed decisions and keeping risk strategies in sync with the company’s objectives.

While many organizations will have one overarching, comprehensive risk management framework, you can also implement smaller-scale, specialized RMFs. For example, an organization might have an enterprise risk management framework and develop a specialized cybersecurity RMF.

Whether specialized or comprehensive, risk management frameworks can cover every aspect of operations, including:

- Operational threats

- Financial and economic risks

- Legal, regulatory, and compliance issues

- Strategic landscape and external factors (e.g., market disruption, economy, or new tech)

- Information technology vulnerabilities and cybersecurity risks

An RMF isn’t strictly about avoiding risks. Risk management frameworks provide a holistic process to understand the threats you face and develop appropriate risk response strategies, whether it’s avoidance, reduction, or acceptance.

Core Components of a Risk Management Framework

Whether a risk management framework is comprehensive or geared towards a specific area like cybersecurity, it has five main components.

1. Risk identification

Risk identification encompasses all your organization’s potential threats, hazards, and risks. At this stage, you’ll want to document everything—don’t ignore risks just because they seem inconsequential or unrealistic. It is, however, valuable to categorize the risks using broad labels, such as:

- Operational risk

- Legal or regulatory risk

- Strategic risk

- Information technology or cyber risk

- Financial or credit risk

- Supply chain risk

- Political risk

- Environmental risk

Or any other categories relevant to your company.

2. Risk measurement and assessment

Next, you need to better understand the hazards you face by performing a risk assessment, measuring the identified risks based on two factors:

- Probability: What is the likelihood that the risk will materialize?

- Impact: If the risk materializes, how much will it hurt your organization?

Some risks are easy to measure—for example, financial threats like unpaid invoices or investment exposure have quantifiable negative impacts. Others, like supply chain risks, can be a little bit harder to estimate, but it’s important to be as methodical and realistic as possible when assessing disruptions.

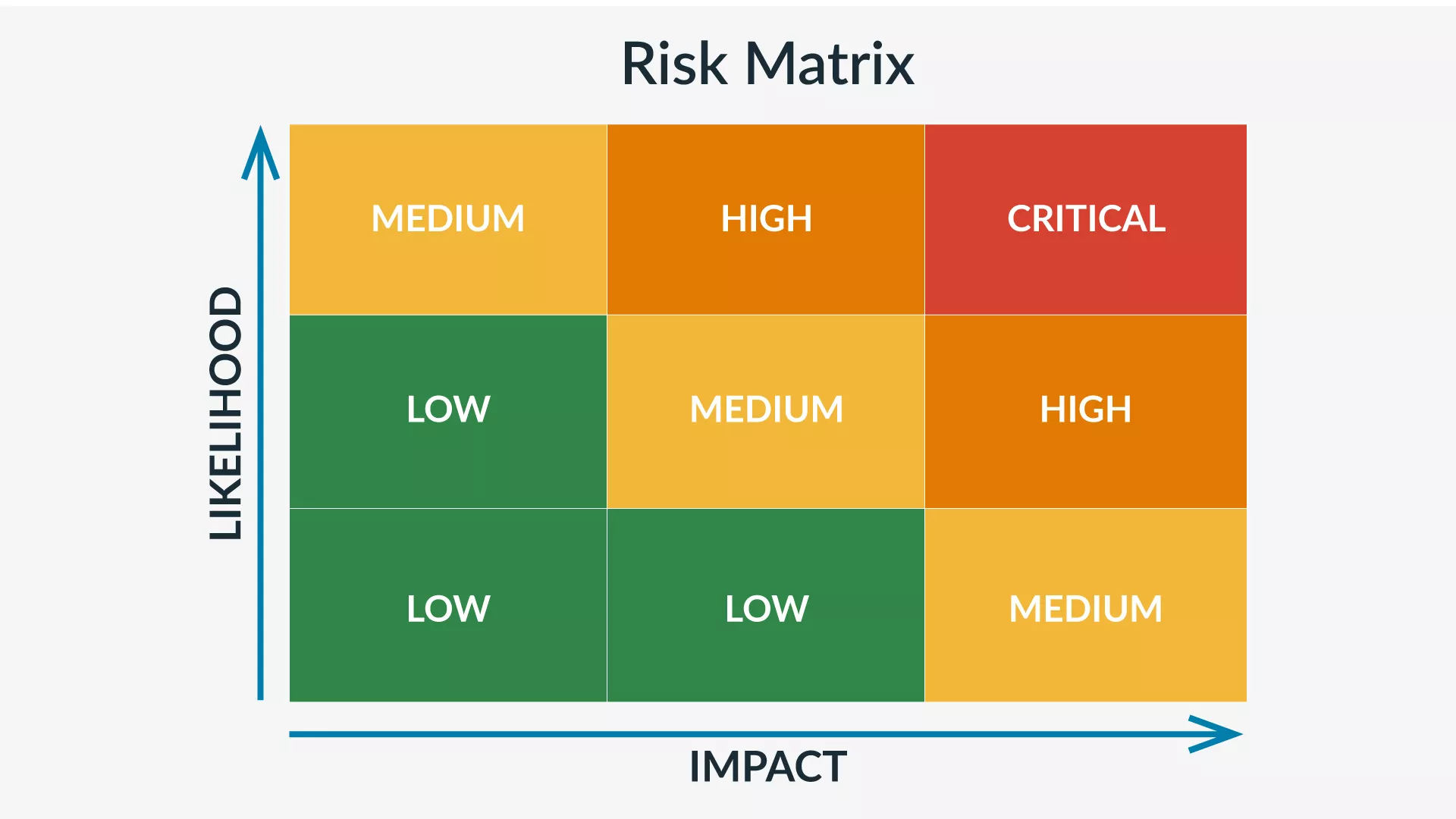

As you perform this impact analysis, plotting threats using a risk matrix can be helpful. The clusters of higher probability/higher impact risks will be a strong visual aid for the next step in the risk management framework.

3. Risk mitigation

Once you understand the potential risks to your organization, you have to decide how to handle them. It’s important to consider all possible risk mitigation strategies in the context of how probable and impactful a given threat is and how important the activity is to your business objectives.

For example, an energy company operating in complex environments like offshore oil rigs or countries with civil unrest faces significant risk. But it’s impossible to do business without those sites, so they’d likely reduce risk as much as possible but ultimately accept it.

Conversely, a financial services company looking at potential investments would likely choose risk avoidance if it came across a low-profit deal with a high likelihood of going bad. They’ll have plenty of other investment opportunities, and a high-risk/low-profit deal would be bad business.

4. Risk reporting and monitoring

RMFs call for continuous monitoring, with reporting and review as critical components. At this stage, you’ll develop processes to monitor the identified risks and mitigation strategies you developed.

Key information to track and document includes:

- Have new risks emerged?

- Have existing risks evolved or become obsolete?

- Has the likelihood or impact of hazards changed from their baseline?

- What organizational changes have altered the landscape of risk management processes?

- What external changes have altered the landscape of risk management processes?

- Are risk management plans up to date, or do you need new ways to mitigate risks?

- How can risk mitigation strategies be improved based upon empirical evidence?

- Can automation help in improving risk management strategy?

For some organizations, risk monitoring is a compliance need, and a regulatory body will dictate the frequency. Other companies should do it as frequently as they reasonably can. Aiming for comprehensive quarterly reviews is a good idea, but some risks—like investments and finances—can call for daily or even real-time reporting.

5. Risk governance

Lastly, risk governance ensures your company stays aligned with its risk-oriented policies and procedures. You’ll lay out all the responsibilities, assign them to appropriate employees, and document approval procedures.

Some key steps at this juncture include:

- Distributing duties to prevent fraud or single points of failure

- Building in oversight and security controls to detect issues

- Seeking approval from your corporate board of directors, if applicable

- Updating and distributing your communications plan to make sure employees understand their responsibilities

Understanding Risk Management Framework Options

Once you decide to implement a risk management framework, your first choice is to use a first-party or third-party RMF. A first-party, internally developed RMF is one you build from the ground up, tailoring it to your organization’s needs.

While the flexibility of an internal RMF can be appealing, you lose the benefits of external validation and established best practices. And starting from scratch means you might be redoing a lot of work others have already covered.

Aside from saving you the effort of starting from square one, a third-party framework’s most significant benefit is that it is already considered standard. You can count on the RMF to provide a solid base, and in specific industries, they’re often a part of regulatory compliance checklists. Implementing a third-party RMF may require adaptation, but it’s generally less work than building from zero.

There are a variety of risk management frameworks available, some of which are industry-specific or focused on specific applications. Here are four of the most widely used RMFs.

| ISO 31000 ISO 31000, published by the International Organization for Standards, is one of the gold standards for enterprise-wide risk management. It covers far more than just an RMF, giving organizations a comprehensive roadmap for risk management. Due to its breadth and regard among international standards, it’s often the ideal choice for companies with a regulatory requirement for RMF implementation. |

| NIST Risk Management Framework The National Institute of Standards and Technology (NIST) Risk Management Framework is a comprehensive set of standards focused on information security, privacy risks, and cyber supply chain hazards. While the NIST RMF applies to federal agencies, government contractors, and intelligence community companies, any company is free to use it.

However, many organizations may find the NIST requirements excessive or poorly adapted to their situation. A good alternative is the NIST Cybersecurity Framework, which is a more flexible set of voluntary standards. |

| COSO Enterprise Risk Management Originally issued in 2004, the Committee of Sponsoring Organizations (COSO) Enterprise Risk Management-Integrated Framework has become an industry leader. It focuses mainly on financial and corporate governance issues and targets C-suites, senior executives, and boards of directors. Over time, the framework has evolved to focus more on integration with organizational strategy and performance. |

| COBIT Developed by the Information Systems Audit and Control Association (ISACA), COBIT is a risk management framework with a heavy focus on IT. Any organization can use it, but it’s especially valuable for organizations with enterprise-level IT operations. Companies with sensitive auditing needs for electronic systems—such as finance-oriented organizations—are also well-positioned to benefit from COBIT.

|

Benefits of Implementing an RMF

Even the most well-aligned and cooperative organizations can struggle to gain a common understanding of risks and how they impact objectives. At worst, stakeholders can silo business risks, waste resources on independent strategies, and focus on competing priorities.

Risk management frameworks reduce these issues by establishing a transparent and standardized process. Theresa Reynolds, Senior Director of Operational Risk Management at Capital One, reflected on this point on The Employee Safety Podcast.

“One of the main benefits, I think, is just giving an organizing structure that leadership can really rally around, particularly when you’re making trade-off decisions with resources. It creates shared clarity when you’re aligning around priorities. Especially when you have different understandings and definitions of what is critical.”

Along with helping leadership align on risk-related issues, RMFs provide several other benefits:

- Improved operational resilience: When your company has a plan for handling risk, you’re more likely to minimize the potential impact, streamline recovery, and maximize business continuity.

- Enhanced reputation and stakeholder confidence: Stakeholders—whether employees, vendors, clients, or shareholders—depend on your company to operate responsibly and stably. A robust RMF gives them faith that your organization will follow through.

- Easier regulatory compliance: Regulatory burden can seem harsh if you’re disorganized or unprepared, especially since many agencies treat effective risk management as a core responsibility. Implementing an RMF will build the work involved into your standard procedures, eliminating the feeling of excess work to maintain compliance.

- Better ability to identify opportunities and threats: Organizational success doesn’t rely on simply avoiding risks—it’s about informed decision-making. An empirical framework will help you separate solid opportunities from activities with a high chance of harming your company.

FAQ

- What types of risks can a risk management framework address? RMFs can address any type of risk, from operational or environmental to financial or regulatory.

- What are the main components of a risk management framework? A strong framework is built on five key pillars: risk identification, risk measurement and assessment, risk mitigation, risk reporting and monitoring, and risk governance

- How do I choose the right risk management framework for my organization? Unless your organization has a regulatory requirement to follow a specific RMF, there are two main factors to consider.

Industry: Is there a framework that’s particularly well-suited to your business, such as COSO’s Enterprise RMF for financial companies?

Resources: Do you have sufficient resources to implement something like ISO 31000, or would a more streamlined framework be helpful? - What is the difference between first-party and third-party frameworks? First-party RMFs, developed in-house, are more flexible but lack the benefits of external validation. On the other hand, third-party RMFs have done a lot of the legwork for you, but can be less flexible and more cumbersome to implement.

- Are RMFs only for large organizations, or can small businesses benefit too? Any size organization can benefit from RMFs. However, it’s important to use a framework your company can support. Dedicating excessive resources to implementation or maintenance, at the expense of your core business, could be counterproductive.

- How often should a risk management framework be reviewed or updated? For most frameworks, a quarterly review is sufficient. However, some specialized RMFs call for more frequent monitoring, including daily reviews in some cases.

- What are some common challenges when implementing a risk management framework? Some of the most common challenges include siloed or poorly understood risks, resource constraints affecting risk mitigation, cultural resistance to change, lack of support from senior leadership, complexity of RMF implementation, and methodology poorly suited to your company.

- Who should be involved in developing and maintaining an RMF? When developing a risk management framework, you should include key stakeholders from all of the relevant areas of your company. For example, an enterprise-wide RMF would include every director, senior VP, or equivalent at your company. It’s also important to involve the C-suite and board of directors, both for operational and regulatory reasons.

Download Our Risk Mitigation Plan Template

More Articles You May Be Interested In

-

Emergency ManagementRisk Management Lifecycle: 5 Steps to a Safer, More Resilient Organization

Emergency ManagementRisk Management Lifecycle: 5 Steps to a Safer, More Resilient Organization -

Emergency ManagementCorporate Risk Management: Proven Strategies to Safeguard Your Business

Emergency ManagementCorporate Risk Management: Proven Strategies to Safeguard Your Business -

Emergency ManagementEnterprise Security Risk Management (ESRM): A Strategic Framework for Modern Security Leaders

Emergency ManagementEnterprise Security Risk Management (ESRM): A Strategic Framework for Modern Security Leaders