Corporate Risk Management: Proven Strategies to Safeguard Your Business

With these corporate risk management strategies and examples, you can learn how to build resilience, ensure compliance, and integrate risk awareness into your company culture for long-term success.

Corporate risk management has never been more critical in an era of increasing uncertainty. Businesses face growing threats, from cyberattacks and regulatory changes to supply chain disruptions and extreme weather events. Without a robust risk management strategy, organizations risk financial losses, reputational damage, and even business failure.

To navigate these challenges, companies must take a proactive approach to identifying, assessing, and managing risks. This post explores proven corporate risk management strategies and real-world examples to help you safeguard your business.

Download Our Risk Mitigation Plan Template

What Is Corporate Risk Management?

Corporate risk management refers to the process by which an organization identifies, assesses, mitigates, and monitors risks that could impact its financial health, reputation, operations, or strategic goals. It focuses on protecting the company’s assets, ensuring compliance with regulations, and maintaining business continuity. Corporate risk management typically focuses on financial, legal, and operational risks directly affecting a company’s bottom line.

Corporate risk management vs. other types of risk management

While corporate risk management is a subset of risk management planning, it is distinct from other forms in these ways:

- Corporate risk management vs. enterprise risk management (ERM) — Corporate risk management focuses on specific risks related to financial performance, regulatory compliance, legal exposure, and operational threats. Enterprise risk management takes a holistic approach, integrating all risks—including strategic, financial, operational, reputational, and emerging risks—into a unified framework that aligns with organizational objectives. ERM also follows established frameworks like ISO 31000 or COSO ERM and emphasizes risk culture across the entire organization, while corporate risk management is more individualized.

- Corporate risk management vs. financial risk management — Corporate risk management covers a broad spectrum of risks, including operational and reputational risks. In contrast, financial risk management focuses specifically on market risks, credit risks, liquidity risks, and financial compliance, often handled by finance departments.

- Corporate risk management vs. operational risk management — Corporate risk management involves high-level risk planning that aligns with your business strategy. Operational risk management deals with risks in day-to-day processes, such as supply chain disruptions, IT failures, or employee safety issues.

Three Foundational Strategies for Effective Corporate Risk Management

Risk is an inherent part of doing business, but organizations that proactively manage threats can protect themselves from a certain level of risk and mitigate losses. Effective corporate risk management requires strategic planning, continuous monitoring, and adaptability. Here are three core strategies businesses should implement to provide a strong base for their risk management framework.

Risk assessments

A comprehensive risk assessment is the foundation of any robust risk management strategy. It’s helpful to have a broad understanding of risks at an enterprise level to manage specific corporate risks. Leveraging industry-standard frameworks such as ISO 31000 and COSO Enterprise Risk Management (ERM) enables organizations to identify, categorize, and evaluate potential threats systematically.

These ERM frameworks provide a structured way to assess risks across various domains, including financial, operational, cybersecurity, and compliance risks. However, any general threat assessment can offer the foundation needed.

A well-executed corporate risk assessment involves:

- Identifying risks through internal audits, historical data, and industry benchmarking.

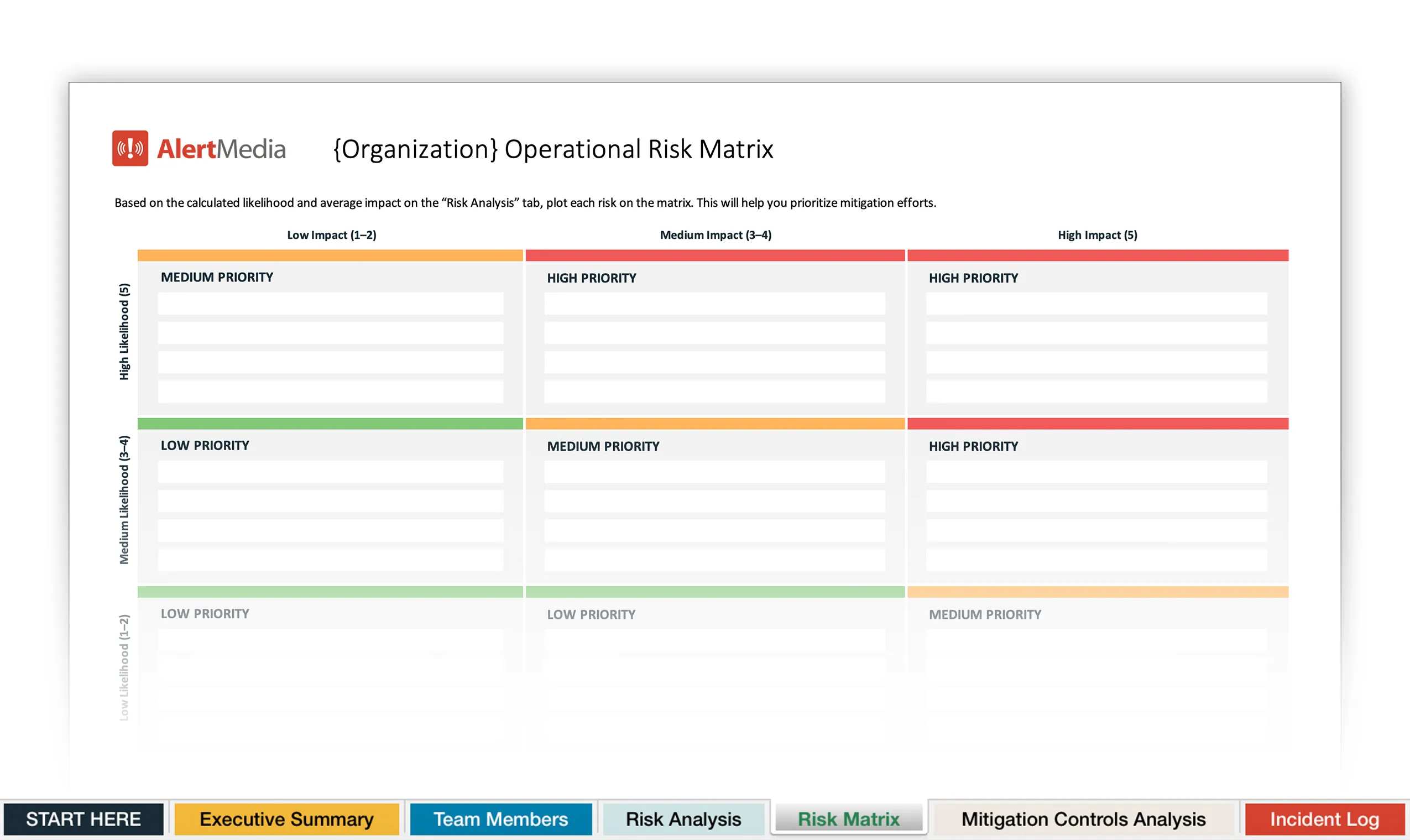

- Evaluating risk likelihood and impact using qualitative and quantitative risk assessment tools.

- Risk prioritization based on the potential effects on business continuity and resilience.

- Developing mitigation plans to address high-priority threats before they escalate.

How to Conduct a Risk Assessment

This video will help you facilitate an effective risk assessment at your organization.

Organizations that conduct regular risk assessments can anticipate disruptions and create strategies that enhance operational stability. Here’s an example of how risk assessments support corporate risk management.

Diversification and redundancy

One of the most effective ways to mitigate corporate risk is to avoid over-reliance on a single revenue stream, supplier, or technology. Diversification and redundancy are key principles that help organizations withstand disruptions by spreading risk across multiple areas. This strategy prevents the failure of one system from disrupting your entire corporate function.

- Supplier and supply chain diversification: Businesses that rely heavily on a single supplier or geographic region for materials face significant risks if disruptions occur due to political instability, natural disasters, or trade restrictions. A diversified supply chain minimizes the impact of localized disruptions and ensures business continuity.

- Revenue stream expansion: Companies that depend on a single product or service for most of their revenue can become vulnerable if market trends shift. By diversifying their offerings, organizations can reduce revenue volatility and maintain financial stability during economic downturns.

- Technology redundancy: From cybersecurity threats to IT infrastructure failures, reliance on a single technology stack can expose businesses to operational disruptions. Consider implementing backup systems, cloud-based redundancies, and disaster recovery plans to ensure business operations can continue despite a system failure.

Proactive compliance monitoring

Regulatory requirements constantly evolve, and non-compliance can result in financial penalties, reputational damage, and legal consequences. Organizations must adopt a proactive approach to monitoring compliance by staying informed about industry regulations, conducting internal audits, and implementing automated compliance tools to stay ahead of these regulatory changes.

Depending on your industry, key compliance areas may include:

- Data privacy laws: Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) mandate strict data protection requirements.

- Cybersecurity standards: In response to rising cyber threats, the U.S. Securities and Exchange Commission (SEC) now requires publicly traded companies to disclose cybersecurity incidents and risk management practices.

- Financial and corporate governance: Organizations must adhere to financial reporting standards like the Sarbanes-Oxley Act (SOX) to maintain transparency and protect investors.

By integrating compliance monitoring into your risk management framework, you can better identify potential regulatory changes early, adjust policies accordingly, and minimize legal risks.

Risk assessment CRM example

Following Silicon Valley Bank’s collapse in 2023, financial institutions intensified liquidity risk assessments to prevent similar failures. The collapse exposed weaknesses in interest rate risk management and deposit stability, prompting banks to enhance stress testing and scenario analysis.

Major firms adjusted risk models to anticipate market fluctuations better, while regional banks diversified funding sources to reduce reliance on uninsured deposits. Many institutions adopted AI-driven monitoring to detect early signs of financial instability, ensuring stronger resilience. By integrating these enhanced assessments, banks safeguard their assets and contribute to broader economic stability, reducing systemic risk in the industry.

Strategies for Managing Physical and Digital Threats

Organizations in today’s global risk landscape must be able to address both physical and digital threats to ensure operational continuity, safeguard assets, and protect sensitive data. However, protecting both spheres of risk requires different approaches. Here are a few strategies you can employ to make sure your corporate risk management can cover both physical and cyber threats.

Managing physical risks: Protecting assets, people, and operations

Businesses face a wide range of physical threats, from workplace accidents to supply chain disruptions and natural disasters. The best way to ensure your people, assets, and facilities are safe from harm is to have the right CRM strategies in place. These three options can get you started:

Workplace safety programs

Programs built around employee safety at work are essential for protecting workers and maintaining compliance with occupational health and safety regulations. Organizations should conduct hazard assessments to identify potential risks in the workplace and implement training programs that educate employees on emergency response procedures.

Real-time safety tracking systems, such as IoT-enabled sensors and wearable devices, can monitor workplace conditions and provide immediate alerts in case of hazards, reducing the likelihood of accidents. Effective communication is also a key factor in workplace safety and should be a priority at every phase of operations.

Supply chain resilience

Building supply chain resilience into your corporate risk management can help your businesses withstand disruptions caused by geopolitical instability, transportation failures, or supplier bankruptcies. For example, AI-based logistics monitoring allows companies to predict delays, optimize inventory, and identify alternative suppliers before disruptions occur.

Disaster recovery & business continuity planning (BCP)

You can’t always prevent a risk from impacting your company. That’s why corporate risk management needs to go beyond and prepare for response, recovery, and continuity. Integrating disaster response and business continuity planning into your CRM prepares your organization to respond effectively to climate events, geopolitical risks, and pandemics. A comprehensive BCP should include detailed response protocols, backup communication systems, and predefined recovery timelines. Companies that develop robust disaster recovery plans can minimize downtime, protect critical infrastructure, and ensure business operations continue even during crises.

Supply chain CRM example

Toyota’s supply chain resilience is exemplified by its strategic production and inventory management approach. The company employs the Just-In-Time (JIT) system, which ensures materials and components arrive precisely when needed, minimizing waste and reducing inventory costs. This methodology allows Toyota to respond swiftly to market demands and operational challenges, maintaining efficiency and adaptability.

Additionally, Toyota fosters close relationships with suppliers, integrating them into its production process to ensure quality and timely deliveries. This collaboration enhances the stability and responsiveness of the supply chain, enabling Toyota to adjust effectively to demand fluctuations or supply disruptions. By integrating these strategies, Toyota has developed a supply chain that supports its operations and sets a global benchmark for resilience and adaptability.

Managing digital risks: Cybersecurity & data protection

Cyber threats pose a significant risk to corporate stability regardless of industry. From ransomware attacks to insider threats, organizations must adopt proactive cybersecurity measures to protect sensitive data and prevent operational disruptions.

Zero-Trust security model

The Zero-Trust security model is a modern approach that assumes no user or system should be automatically trusted. Multi-factor authentication, endpoint monitoring, and least-privilege access controls continuously verify every access request. This model significantly reduces the risk of insider threats and unauthorized access to critical systems.

Incident response & ransomware protection

Prioritizing incident response is crucial in mitigating cyberattacks’ financial and operational impact. Organizations should conduct regular penetration testing to identify vulnerabilities, maintain secure offline backups to prevent data loss, and develop cyber incident playbooks to streamline response efforts.

AI-powered threat detection

Recent advances in AI technology make finding AI tools to manage cyber risks easier and more cost-effective than ever. Some tools use machine learning algorithms to identify abnormal network activity and detect cyber threats in real time. Advanced security analytics can recognize suspicious behavior, automate threat mitigation, and reduce response times. Financial institutions and e-commerce platforms have widely adopted AI-driven cybersecurity tools to prevent fraud and data breaches before they escalate.

Cybersecurity CRM example

In 2024, Microsoft launched its Secure Future Initiative (SFI), marking its most extensive security transformation to date. This initiative involved 34,000 full-time engineers and introduced measures such as enhanced token and key management systems, elimination of inactive tenants, and stricter project security monitoring. Additionally, Microsoft established a Cybersecurity Governance Council and appointed deputy chief information security officers (CISOs) to strengthen its security culture. These efforts underscore Microsoft’s commitment to integrating cybersecurity risk management into its corporate strategy.

Similarly, T-Mobile committed to investing millions in upgrading its cybersecurity protocols as part of a settlement with the U.S. Federal Communications Commission (FCC). The company agreed to a $15.75 million investment in cybersecurity enhancements and equivalent civil penalties. This initiative aims to bolster T-Mobile’s cybersecurity posture and reduce the risk of future incidents. These examples highlight how leading corporations proactively implement comprehensive cybersecurity risk management strategies to protect their operations and customer data.

How Technology Supports CRM

The pacing and scale of modern threats require modern tools to keep up. Leaning on the right technology can enhance your corporate risk management by improving risk identification, assessment, and mitigation. These are just a few of the ways technology can enhance your CRM.

- AI-driven risk assessment — Use machine learning and predictive analytics to detect emerging risks by analyzing financial, operational, and cybersecurity data.

- Cybersecurity & threat detection — Turn to AI-powered security tools and real-time monitoring systems to prevent cyber threats and data breaches.

- Compliance automation — Use governance, risk, and compliance (GRC) software to automate regulatory tracking, reduce legal risks, and ensure adherence to evolving laws.

- Supply chain resilience — Employ blockchain, IoT sensors, internal controls, and AI forecasting to improve supply chain transparency and minimize disruption risks.

- Digital continuity & recovery — Set up cloud backups, automated failover systems, and virtual desktops to enable quick recovery from cyberattacks or operational failures.

- Workplace safety & incident management — Invest in safety sensors, threat monitoring tools, and robust emergency communication systems to improve employee safety and operational risk response.

Technology is transforming corporate risk management by providing real-time insights, enhancing security, and automating compliance. Businesses that embrace digital risk management tools can proactively detect and mitigate threats, ensuring long-term stability and growth.

Building a Risk-Aware Culture

A strong company safety culture that prioritizes corporate risk management is one of your best strategies to ensure employees at all levels understand and actively mitigate risks. Organizations that embed risk awareness into daily operations create a more resilient workforce and reduce vulnerabilities. Here’s how to build a company culture that can support corporate risk management:

Employee training & awareness

Education is key to fostering a proactive approach to risk management. Regular training programs should cover:

- Safety reporting — Teach employees how to report hazards or incidents and ensure any reports are taken seriously without retaliation

- Crisis Response — Conduct scenario-based drills or tabletop exercises for cyber incidents, supply chain disruptions, and physical security threats.

- Cyber Hygiene — Teach employees to recognize phishing attacks, use strong passwords, and follow secure data handling practices.

- Compliance Requirements — Keep employees informed on evolving regulations such as data privacy laws and industry-specific mandates.

Other ways to make corporate risk management training engaging and effective are interactive workshops, simulations, full-scale drills, and e-learning platforms.

Leadership involvement

Risk awareness must start at the top. When executives and any board of directors integrate risk management into corporate governance, it signals its importance across the organization. Assigning chief risk officers (CROs) or dedicated risk committees to oversee enterprise-wide initiatives ensures that risk management remains a strategic priority. Additionally, incorporating risk assessment discussions into executive/board meetings and long-term strategic planning helps embed risk awareness into decision-making processes.

Establishing clear accountability frameworks reinforces key stakeholders’ responsibility, ensuring risk-related decisions are owned and acted upon at the highest levels. When leadership consistently prioritizes risk management, employees are more likely to adopt risk-conscious behaviors, creating a culture of proactive risk mitigation.

Continuous threat monitoring

A risk-aware culture isn’t just about preparation—it’s also about ongoing vigilance. Organizations should:

- Use threat intelligence platforms to track risks, regulatory updates, and geopolitical shifts.

- Monitor internal and external risks through analytics and automated alerts.

- Encourage reporting by fostering a no-blame culture where employees feel safe identifying potential risks.

By making effective risk management a continuous and company-wide effort, you can proactively address challenges before they escalate. When corporate risk management becomes part of daily decision-making, organizations enhance resilience and long-term success.

Corporate Resilience Fundamentals

Corporate risk management is not just a defensive strategy but a fundamental component of holistic business resilience. When integrated effectively, it enhances an organization’s ability to navigate uncertainty while maintaining operational stability, financial strength, and regulatory compliance. However, corporate risk management does not operate in isolation. It works best when aligned with broader risk management frameworks, such as enterprise risk management (ERM), financial risk management, and operational risk management.

Businesses can create a more comprehensive, agile, and forward-looking approach to risk governance by fostering collaboration across these disciplines and disparate risk management teams. A well-structured corporate risk strategy protects against potential threats and empowers organizations to seize new opportunities—even those with inherent business risk—with confidence, ensuring long-term sustainability and growth in an unpredictable world.