Navigating Uncertainty With an Enterprise Risk Management Framework

An enterprise risk management framework is about more than adapting to risk. It helps you grow beyond the threats you face.

Modern risks aren’t static. Progress and innovation give businesses more access to the tools they need to meet their goals, but the other edge of that opportunity harbors threats. In today’s rapidly evolving threat landscape, organizations face a myriad of risks, ranging from cyberattacks and data breaches that can compromise sensitive information to supply chain issues that disrupt business operations. Geopolitical uncertainties, regulatory changes, and the impacts of global events like pandemics further contribute to the complexity of the risk landscape.

You need a flexible enterprise risk management framework (ERM) to tackle that. Your ERM process sets the tone for responding to all threats so you can adapt swiftly and strategically while ensuring business continuity.

Download Our Risk Mitigation Plan Template

What is enterprise risk management (ERM)?

Enterprise Risk Management (ERM) is a comprehensive framework organizations can use to identify, assess, manage, and monitor risks that could impact their strategic goals. Unlike traditional risk management processes, which tend to focus on specific areas like finance or operations, ERM takes a holistic approach, addressing risks across the entire organization’s departments and functions. The goal is to create a unified strategy for mitigating risks, ensuring that all potential threats—whether financial, operational, technological, or regulatory—are managed proactively.

Why You Need an Enterprise Risk Management Framework

An enterprise risk management framework (ERM) is a flexible solution that goes beyond reacting to threats. Ideally, it empowers you to meet business goals while consistently overcoming challenges in your industry. An ERM provides a structured and adaptable set of guidelines for various scenarios. Here are some benefits of implementing a well-thought-out ERM framework.

- Proactivity: The worst time to establish a risk management plan is when facing a threat. Panic can feed into ineffective stopgap decisions. With a proactive approach to risk identification, you position yourself to make informed and strategic choices, fostering resilience and minimizing risk exposures.

- Flexibility: The ERM framework is not built for a single, major threat. It incorporates all types of risk, whether you face a new data protection law or supplier disruption from a hurricane. The ERM framework guides all your overall business processes, making it suitable for all risk types.

- Resilience: Many risk management plans focus on weathering the storm, putting business goals on hold. For enterprises, the purpose of their operation is to provide value. If they cannot do that, the very core of their existence is compromised. Resilience in risk management means surviving challenges and ensuring the continuous delivery of value, even in the face of adversity.

- Agility: Agility differs from flexibility in addressing risks’ interconnected and cascading nature. While flexibility involves adapting to the type of risk, agility is about responding to the unforeseen consequences and interdependencies that may arise from a specific scenario. For instance, in the case of natural disasters, agility means adapting to the initial impact and then swiftly shifting to secondary effects, such as power outages putting building security at risk.

- Rapid response: Quick and decisive action is the most valuable resource in any emergency, especially when employing risk mitigation strategies. Time is of the essence, and a rapid response lessens the immediate impact and establishes a foundation for a more controlled and well-managed resolution in critical situations.

One clear benefit of adopting an ERM framework is its contribution to an effective risk management lifecycle. The key lies in having a well-established plan that can be followed and communicated consistently. Fortunately, ample guidance is available for developing and implementing an effective ERM.

The Components of ERM From COSO Guidance

The Committee of Sponsoring Organizations of the Treadway Commission is considered one of the foremost enterprise risk mitigation and management experts. They wrote the book on it.

The COSO is an established joint venture of five influential private sector organizations working collaboratively to enhance organizational performance and governance. Their notable contribution is the development of comprehensive frameworks. They published the COSO Enterprise Risk Management—Integrated Framework for COSO ERM processes, which has gone through several iterations.

This publication is several hundred pages long and encompasses many ERM strategies. However, for simplification purposes, it breaks its framework into a series of five broad categories:

Corporate governance and cultureThis category covers establishing oversight and a risk-intelligent culture. | Strategy and objective-settingThe business establishes its risk appetite and aligns its strategies with business goals. | Performing the action planPerformance involves identifying and prioritizing critical risks while implementing responses as necessary. | Review and revisionIn the review and revisions stage, the enterprise collects metrics on what was done wrong, what was done right, and what needs to change. | Communication and reportingFinally, the organization publishes an internal audit of its risk, communicates plans, and uses the information to improve responses. |

Alternative Guidance from ISO 31000

Another commonly turned-to resource for risk management is ISO 31000. The International Organization for Standardization offers a comprehensive guide to risk management that leaders can adapt to organizations of all sizes. This set of principles has much in common with the ones established by COSO, providing a globally recognized framework that emphasizes a systematic and integrated approach to managing operational risks.

Of course, as they are internationally recognized standards, both are extremely extensive. Suppose you’d like something a bit more manageable that you can adapt to your organization. In that case, you can also use AlertMedia’s risk mitigation template to start addressing your enterprise’s threats.

Cultivating Risk Awareness From the Top Down

Risk intelligence is vital to ERM frameworks because individuals can hold themselves responsible only for the threats they are aware of. Organizations must continuously gather information on these threats and communicate them to key stakeholders on their team, from front-line employees to the board of directors. Here are some methods for managing this.

- Conduct periodic risk assessments to identify and analyze potential threats, evaluating internal and external factors impacting the organization.

- Implement monitoring systems and tools to track changes in the business environment, industry trends, and emerging risks. Automated tools and real-time data collection can be particularly valuable for highly regulated industries.

- Establish a robust risk reporting system for employees to report potential threats, and consider adding anonymous options to encourage a culture of openness without fear of retribution.

- Use external intelligence sources, such as threat intelligence services, industry reports, and regulatory updates, to stay informed about evolving risks that may affect the organization.

- Establish feedback mechanisms like surveys and focus groups to gather insights from employees, customers, and stakeholders. These individuals may be more familiar with your organization’s realistic threats and can offer insight into them.

- Conduct safety audits of various risk segments, like fire emergency planning or cybersecurity, to spot-check your plan and quickly address any issues.

- Provide ongoing employee training on risk awareness and reporting procedures, ensuring everyone in the organization understands their role in identifying and addressing potential threats.

Balancing Your Risk Assessment With Your Risk Appetite

A risk assessment is a common step in building any response plan. However, most risk assessments stop there—at identifying the risk and discussing measures to avoid it. At the same time, accepting some level of risk is necessary for business growth.

For example, consider an enterprise transitioning from a privately traded company to a publicly traded one. This shift is a massive growth driver, opening new avenues for capital, visibility, and innovation. However, it also introduces risks associated with increased scrutiny, such as regulation and compliance risks and market volatility.

There is financial risk, and that risk is significant. However, the enterprise recognizes that the opportunity to go public outweighs the danger. Given the organization’s risk appetite, this is acceptable.

Any good risk management strategy involves a tangible understanding of the organization’s risk profile. When going public, the enterprise must have a clear view of the risk events involved and use a methodology that aligns them with goals. This ensures that the decision to take the company public is a strategic risk that maximizes the potential for growth while staying within acceptable boundaries. This practical approach to risk management is essential for navigating major business transitions and capitalizing on strategic opportunities.

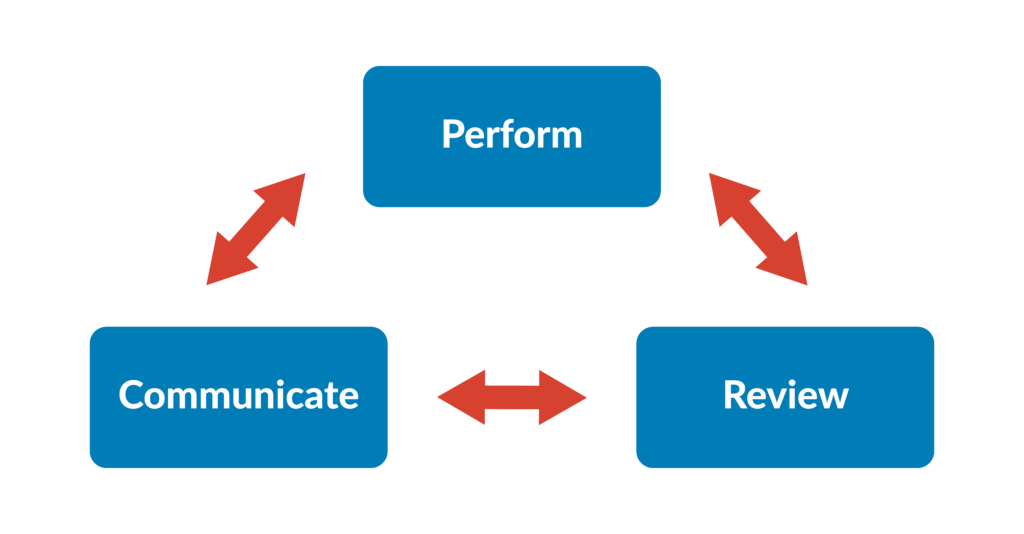

Performing, Reviewing, and Communicating Your ERM Program

Performing, reviewing, and communicating an ERM framework is a continuous cycle where you will revisit each section time and time again, ideally improving along the way. This iterative process is essential for organizations to actively manage risks, enhance resilience, and ensure alignment with strategic objectives.

Putting Your Action Plan Into Practice

When implementing your plan, you should effortlessly progress through four risk review and risk response stages, aligning with your business objectives.

Identify | Prioritize |

|

|

Allocate | Implement |

|

|

Evaluating Your Risk Management Practices

While an after-action review is not an inherent part of a traditional risk management program, it can be closely related and complementary. AAR is typically used to evaluate and learn from past actions or events, identifying what worked well and what could be improved. In contrast, a risk management framework concentrates on identifying, assessing, and mitigating risks before and during the execution of a plan or project, ensuring alignment with strategic goals.

Here are some questions senior management and other business leaders can consider in adopting an AAR approach for their ERM framework:

- What aspects of the ERM program were executed successfully, and how can we build on these achievements across business units?

- Where did we encounter challenges or errors in the execution, and what measures can we take to address and prevent similar issues?

- What actions contributed to positive outcomes, and how can we integrate these into our internal controls?

- What areas require improvement in our risk control strategies, and what concrete steps can we take to enhance our approach?

- Were there any unforeseen circumstances or gaps in our decision-making, and how can we better anticipate and mitigate similar issues in upcoming projects?

A Framework for Continuous Improvement

Your enterprise risk management framework is critical to skillfully evaluating and navigating threats. Acknowledging that some risks are inevitable and, in fact, necessary for progress—your ERM framework empowers you to proactively identify, analyze, and address these challenges. This strategic tool fosters a resilient and adaptable organizational approach, safeguarding against potential disruptions and empowering your organization to embrace calculated risks.