Navigate Threats With

Human-Verified

Risk Intelligence

Critical events are increasing in both number and severity. Know immediately when your people or business are at risk, assess impact instantly, and respond with confidence using the industry’s only human-verified risk intelligence system designed to deliver facts, not false alarms.

Trusted by Thousands of World-Class Organizations

A Comprehensive Solution for Faster

Threat Detection & Response

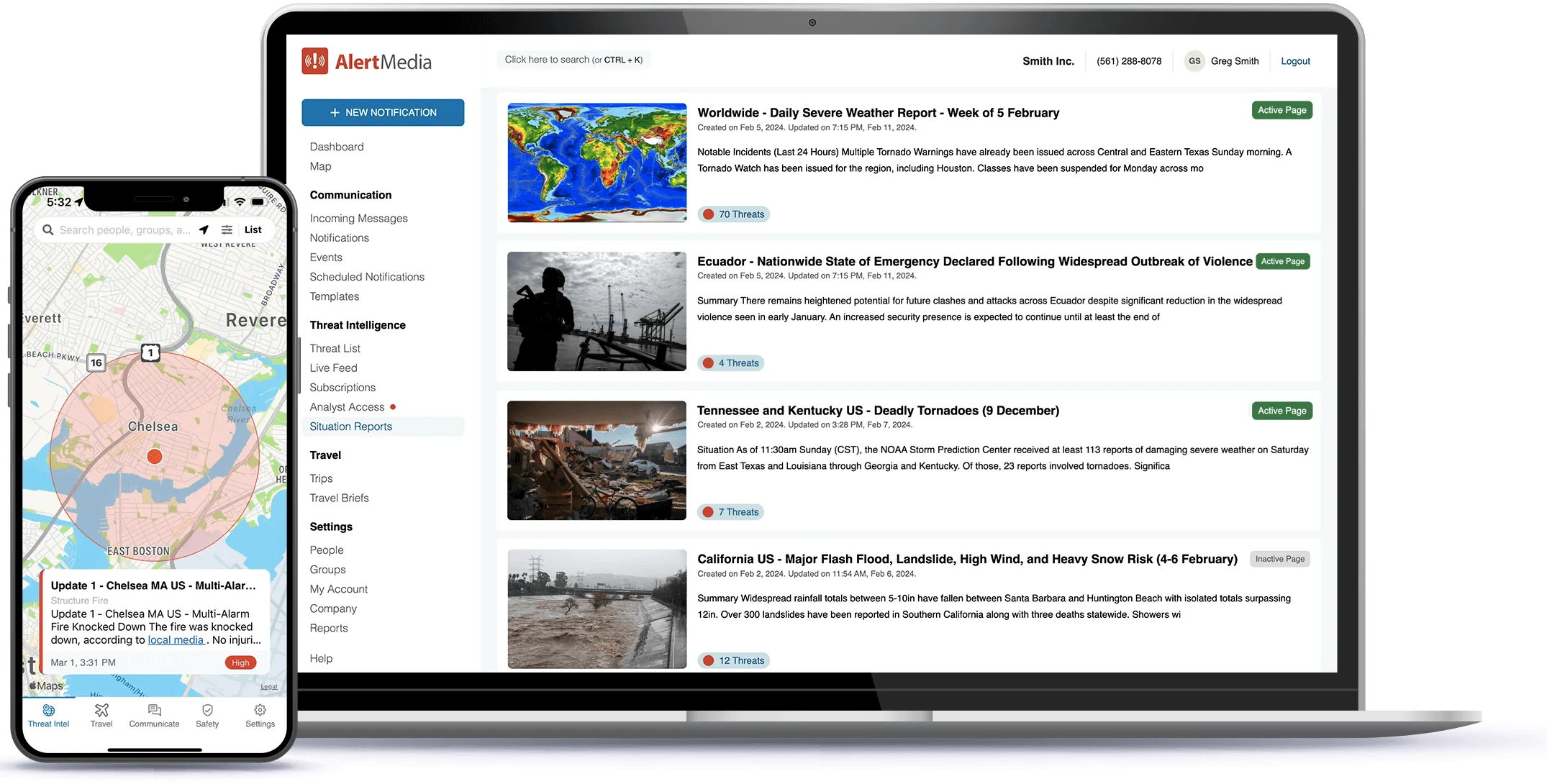

- Scale Security OperationsWhether you’re a team of one or many, it can be hard to stay ahead of safety and operational risks. Our intelligence team acts as your eyes and ears so you can meet the demand of protecting your people and business at scale.

- Focus on Facts, Not False AlarmsPublic information is a gold mine for early signals about any incident, but it comes at the cost of wading through noise and false positives—wasting valuable time during an emergency. Our experts filter out the noise for you and distill the facts, delivering intelligence you can trust and act on.

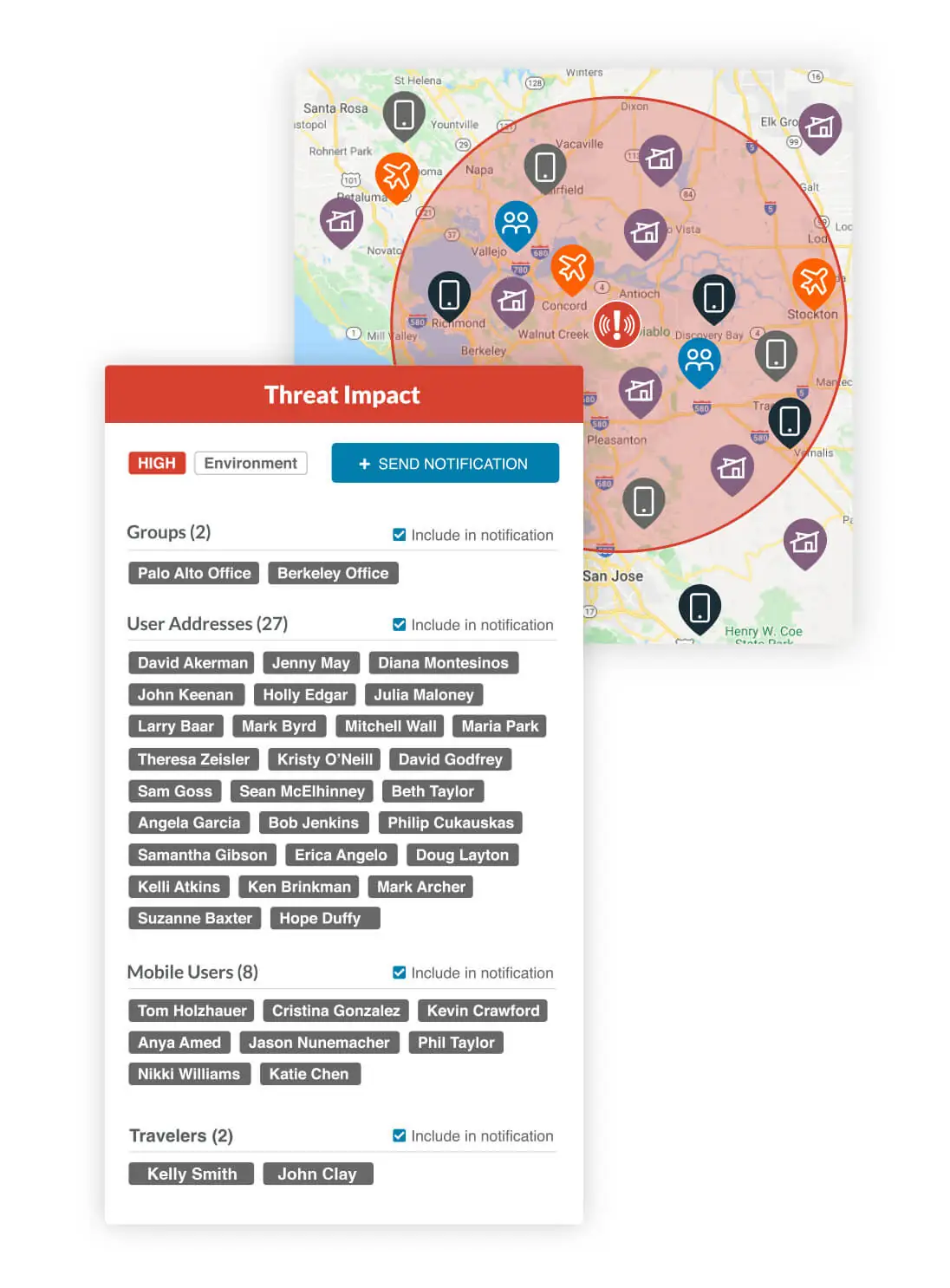

- Alert the Right People, Right AwayProtecting your people and business 24/7 is daunting for any organization, regardless of resources. AlertMedia lets you know the minute your people or assets are at risk with automated alerts delivered over every channel to every person that needs to know.

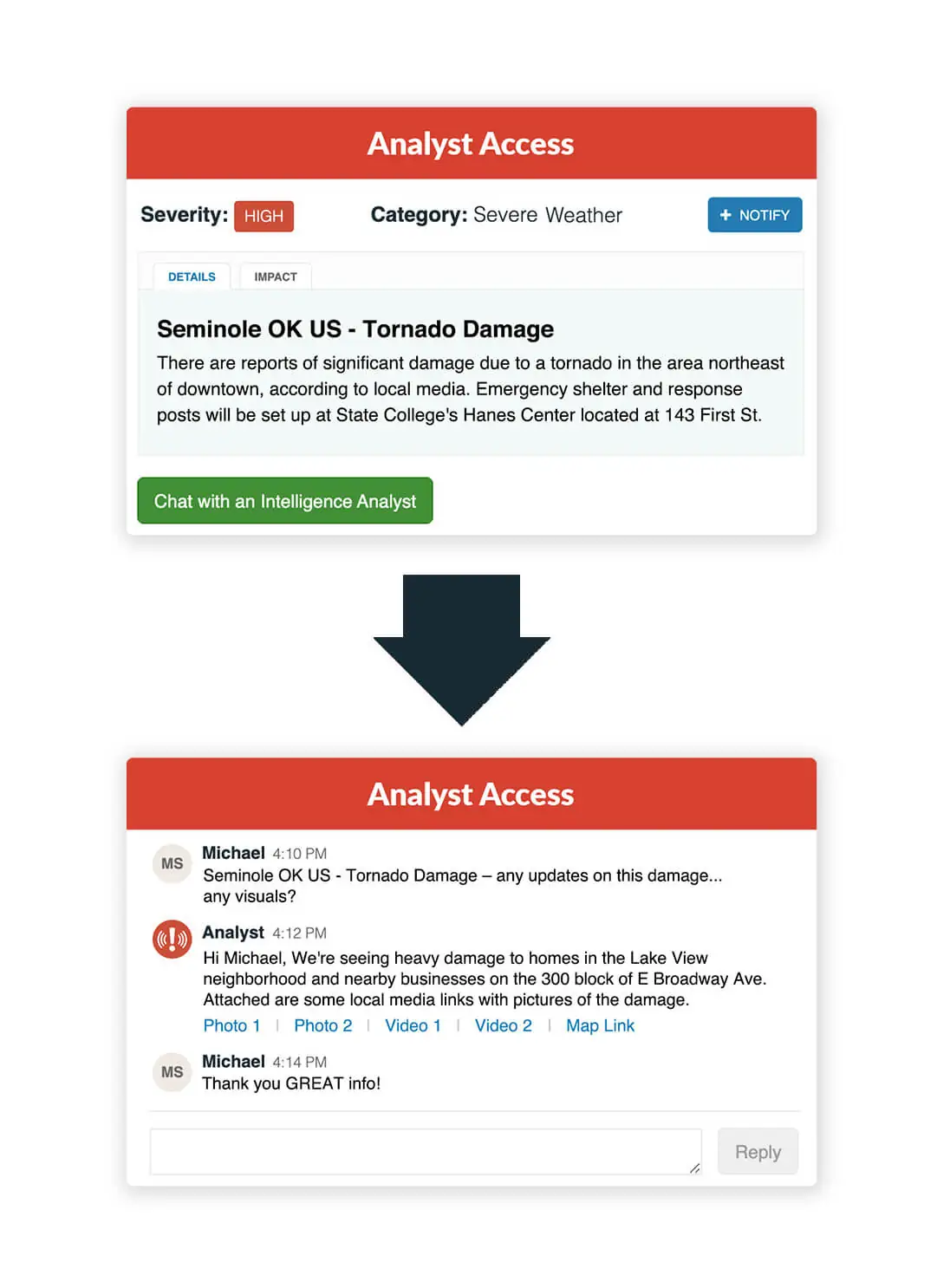

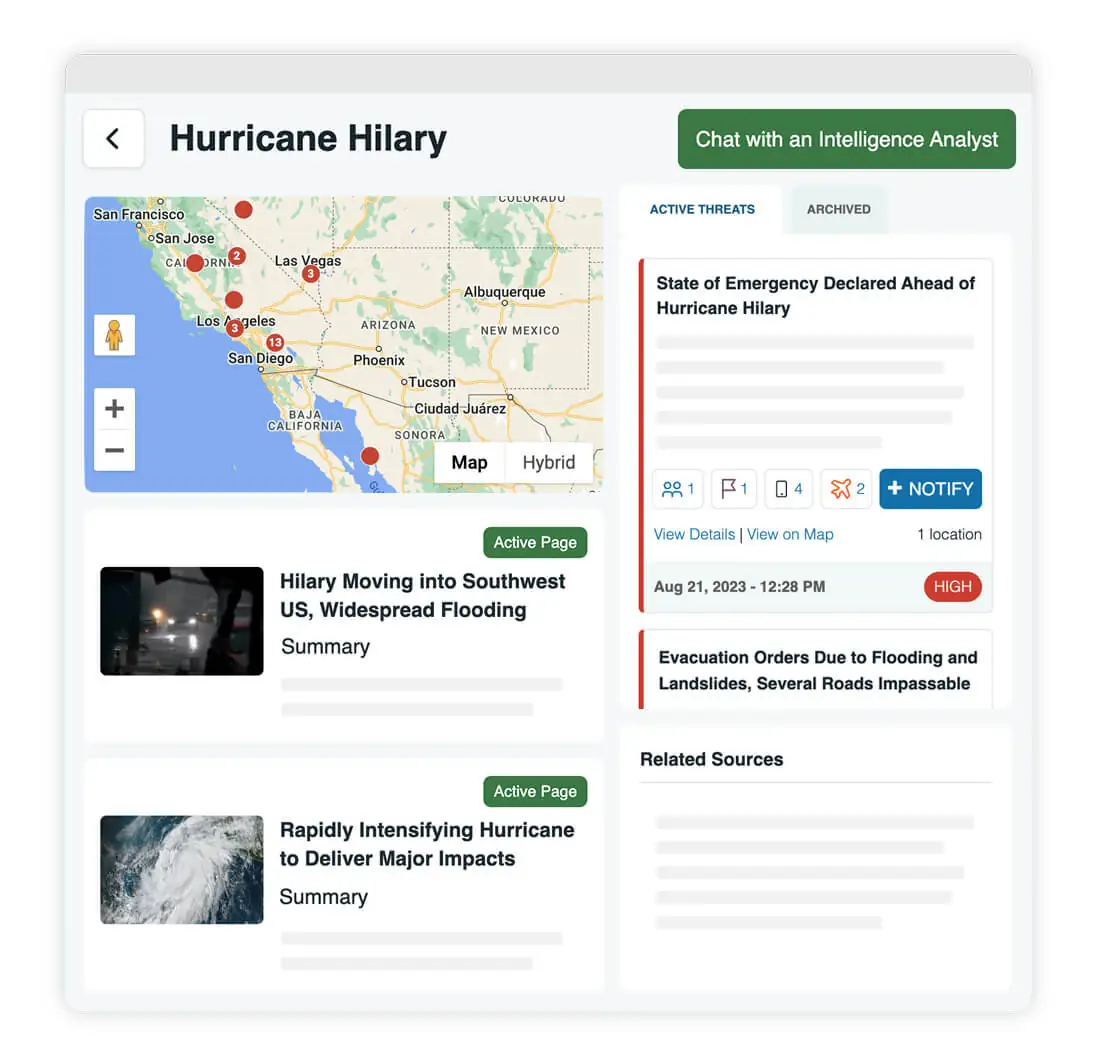

- Engage Experts for Impactful InsightsGathering reliable context about a developing situation is challenging. AlertMedia is the only solution providing instant, 24/7 access to expert analysts via live chat—helping you get the information needed to assess impact to your business, make better decisions, and respond with confidence.

- Dive Deeper Into Major EventsLocating unbiased and accurate information about the impacts of high-profile events can be challenging. AlertMedia’s expertly curated Situation Reports, weekly intelligence briefs, and daily weather forecasts help you stay ahead of events happening worldwide.

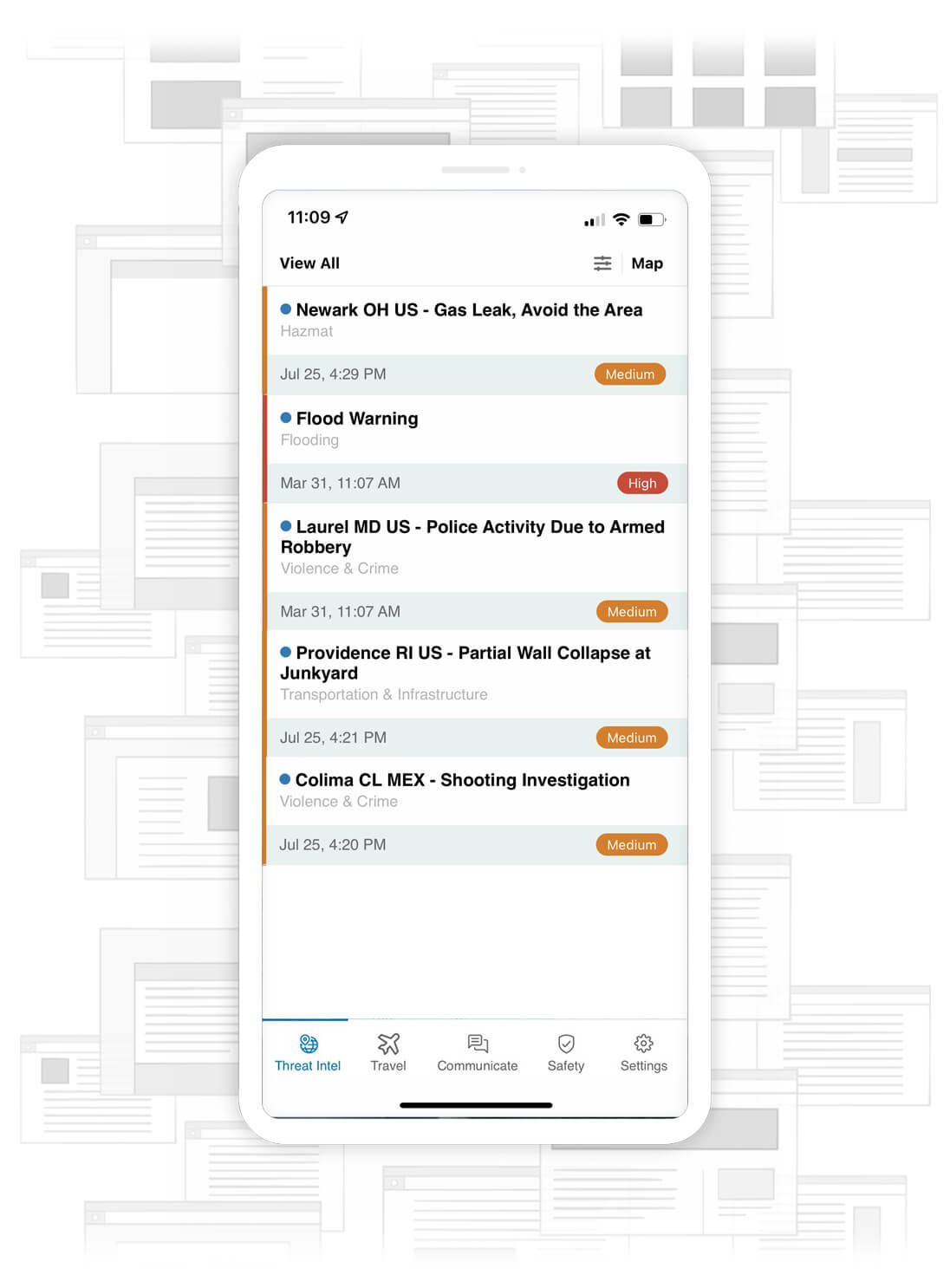

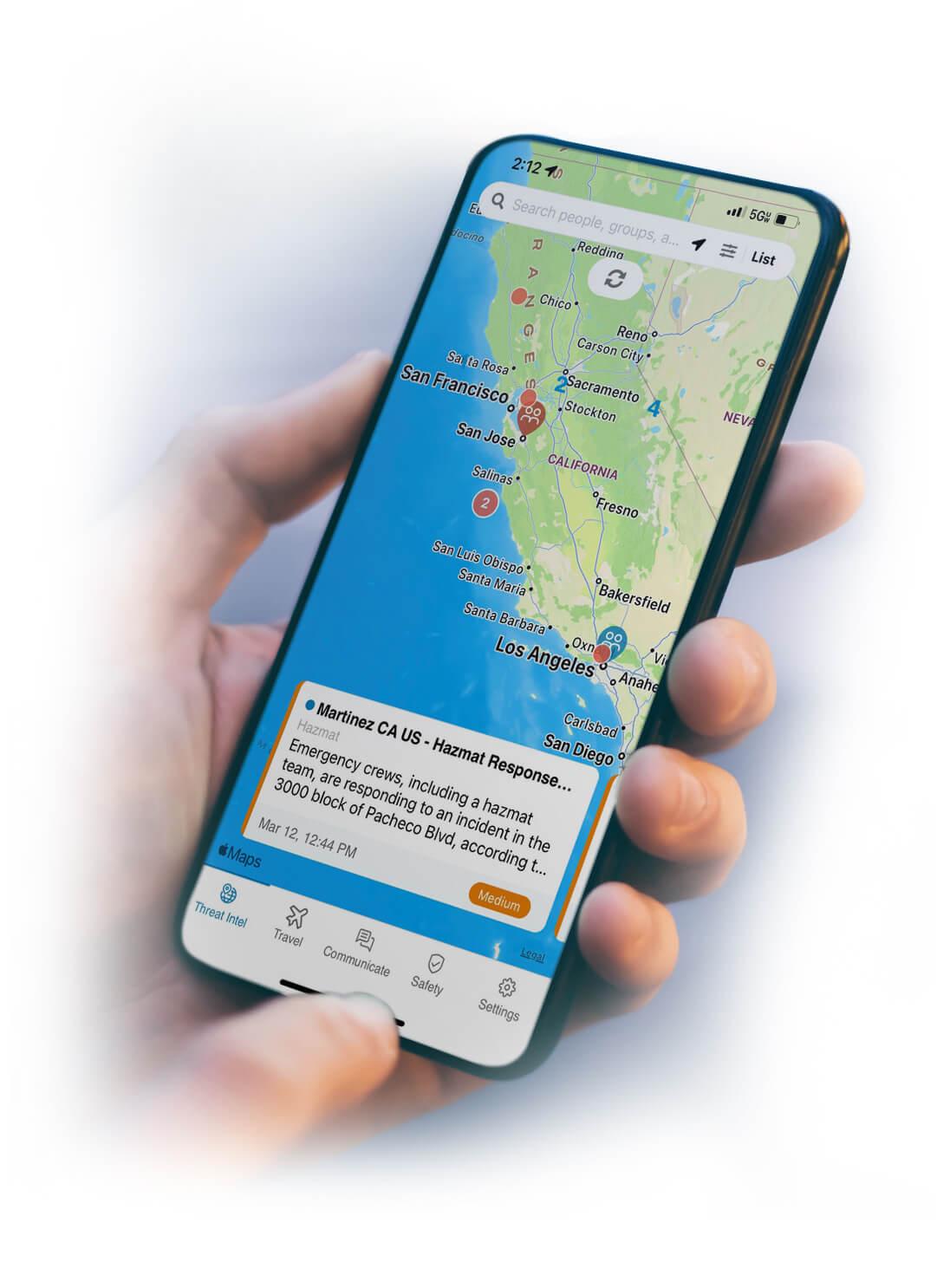

- Stay Aware, From AnywhereMitigating risk requires around-the-clock visibility and the agility to respond anytime, anywhere. A full-featured mobile app puts the power of actionable intelligence in your pocket, giving you the flexibility to respond on the go.

Gain a Trusted Source of Risk Intelligence—Free From Noise

Real-Time Threat Alerts

Notify stakeholders and impacted employees immediately when a threat is identified near your people or locations.

Customizable Live Feed

Identify risk to your business faster with customizable threat warnings that help you monitor what matters around your people and assets.

In-Depth Risk Assessment

See impacted assets and cut out the noise of irrelevant threats to focus resources on what matters to your business.

Historical Threat Insights

Pull historical threat reports and risk data to streamline incident analysis, plan for the future, and aid in future decision-making.

24/7 Analyst Access

Quickly gather and vet contextual information about a developing situation with around-the-clock access to our global intelligence team via live chat.

Live Weather Briefings

Access interactive weather forecasts with our team of meteorologists to better understand the potential impact to your people and business.

See Everything You Can Accomplish With AlertMedia

Mass Notification

Travel Risk Management

A Simple Solution for Today’s Complex Threats

Global 24/7 CoverageGlobal and local coverage of active incidents, planned events, severe weather, and natural disasters.

Global 24/7 CoverageGlobal and local coverage of active incidents, planned events, severe weather, and natural disasters. Expert AnalystsIntelligence verified by expert analysts from ex-government agencies, Fortune 500 security operation centers, and law enforcement.

Expert AnalystsIntelligence verified by expert analysts from ex-government agencies, Fortune 500 security operation centers, and law enforcement. Fast and AccurateExpert verification using AI and a proprietary tool that pulls from thousands of sources to deliver a comprehensive assessment of global risk.

Fast and AccurateExpert verification using AI and a proprietary tool that pulls from thousands of sources to deliver a comprehensive assessment of global risk.

What Customers Are Saying

“By far, AlertMedia’s combination of high-speed notifications and threat intelligence has proved to be the most agile tool we’ve used to date.”

Penny Neferis

Director of Business Continuity and Emergency Response, JetBlue

“With AlertMedia, we can efficiently get the information we need to make decisions as a security team. When we worked with open source intelligence, we tried to monitor and analyze every threat ourselves, and it wasn’t feasible anymore. It takes a dedicated team of intelligence analysts to turn information into meaningful intelligence; we don’t have that. But AlertMedia does.”

Richard Grue

Global Head of Physical Security & Safety, Qualtrics

“Our people are our primary asset. We’re focused on reducing business risk through resilience—and AlertMedia allows us to take a proactive approach to monitoring threats.”

Doug MacNab

Senior Director of Operations, The Leukemia & Lymphoma Society