BCP in Banking — 12 Steps to Disaster-Proof Operations

How will a disaster impact your business? What financial hit will your organization suffer? And how quickly can you recover? Take steps now with business continuity planning.

Financial institutions, including banks, credit unions, accounting firms, and loan offices, are all vulnerable to security breaches, unforeseen emergencies, and operational disruptions. With millions—or potentially billions—of dollars at risk, there is a critical need for business continuity planning. Well-detailed and regularly tested BCP in banking can help you protect customers and employees while maintaining critical operations.

— Jim Wetekamp, CEO of Riskonnect

The Four Phases of Crisis Management for Banks

Business continuity planning, or BCP, in banking must address all the threats a financial institution faces. Severe weather events like hurricanes, tornadoes, blizzards, and wildfires can disrupt physical locations. Digital threats and cyberattacks put customer privacy and critical information systems at risk. Operational disruptions, economic downturns, regulatory changes, and the impacts of the pandemic further underscore the need for an effective business continuity plan for banks.

Crisis management follows four stages: mitigation, preparedness, response, and recovery.

Mitigation

Reduce the threats or impact of threats to your business. | Preparedness

Be prepared for the threats you can’t eliminate. | Response

Put your plan into action when disaster strikes. | Recovery

Recover from the disaster and return to business as usual. |

A business continuity plan for financial institutions focuses on the risk mitigation and preparedness stages. You will review your exposures, threats, and risks as you learn how to prepare for them. The Federal Financial Institutions Examination Council (FFIEC) has issued detailed guidelines to help financial institutions maintain business continuity and operational resilience amid disruptions.

Business Continuity Plan Template

Achieve Stability and Resilience With a BCP in Banking

The need for robust business continuity strategies has taken center stage in an era marked by anticipated and unforeseen disasters. But beyond the planning, everyone from frontline employees to senior management must be on board with the plan and understand their parts in supporting business continuity. These twelve steps to BCP in banking will help you prepare, beginning with a thorough evaluation of your risks and leading to training and implementation once a version of the plan is complete.

1. Complete a business impact analysis

How will a disaster impact your business? What financial hit will your organization suffer? And how long will business recovery take? The first step in BCP in banking is to address some critical questions with a business impact analysis. You’ll want to thoroughly understand what a disaster means in the context of operational resilience.

Here are some key actions of your business impact assessment:

- Define critical business functions: This is important for prioritizing your financial institution’s resources and determining the costs associated with downtime. If your organization is open to the public (such as a bank), you’ll want to consider the impact on customers and proactive solutions for mitigation.

- Calculate downtime costs: Depending on the specific nature of the emergency, operations could be halted for hours, days, or even weeks—like with catastrophic damage due to a major hurricane. It’s essential to evaluate a range of financial consequences.

- Determine legal impact: With any disaster, there are inevitable regulatory considerations to address. Customer and data privacy will be a top concern for financial institutions’ business continuity. If you relocate any facilities, you’re required to notify the organization’s primary federal regulator.

You’ll also want to review each department’s vital needs for your business impact analysis. You might ask: Does my organization have the necessary specialized equipment/software? How will I notify my people if internet access is unavailable? And what communication system will I need to facilitate recovery?

2. Complete a risk assessment

One essential component of business continuity management is understanding the risks unique to your industry and specific to your organization. Threats can come in various forms: malicious activity targeting your employees and customers, a technical disruption, or a natural disaster beyond your control. Establishing a scale of anticipated threats helps evaluate the severity of the risk. A low-impact threat might be a temporary power outage, whereas an active shooter scenario or wildfire could have serious business repercussions.

The risk or threat assessment should consider the following:

- Internal and external danger to personnel, facilities, and service providers

- Business disruption due to natural, technical, and human threats

- Vulnerability of critical processes and vital data/records

- Probability of occurrence (use a rating system)

- Impact of a scenario on your people, business, and customers

Effective business continuity plans should consider your facilities’ geographic locations. Close proximity to a flood plain or critical infrastructures (e.g., airports, highways, nuclear power plants) can affect your organization’s risks.

3. Inventory internal resources

Identify the resources you need to support operations during an emergency, including personnel, information technology and infrastructure, operational resources, and procedural resources.

Personnel

| Technological

| Operational

| Procedural

|

Categorizing those items and alternative solutions will ensure you have the people, processes, and equipment needed to continue operations despite a disaster.

4. Create an emergency communications strategy

The first part of an emergency communications plan is detecting potential threats. Consider using a threat intelligence solution to stay on top of emerging critical events so you can prioritize time-sensitive notifications to employees and other stakeholders.

When your threat intelligence is integrated with your employee communication software, you can ensure safety, security, and business continuity. Look for a communication solution that meets the following criteria:

- An intuitive interface: This feature will make it easier for anyone to send out critical information.

- Two-way messaging: This lets your people reply with real-time status updates.

- Wellness checks: You can conduct quick surveys of employees to check if they’re safe or need assistance.

- Geofencing: This location-based feature allows you to group recipients based on who might be in close proximity to (or in the path of) a disaster

- Always available: A disaster can occur any day, at any hour. Your communications software should always be prepared.

With the right supportive software, it’s easier to establish a strong employee communications plan to keep your workers up to date and on task, even during disaster response and recovery.

5. Develop your backup plan

In financial services, the recovery point objective–the point, as measured in time, where data loss exceeds what is acceptable–is very short. Your core data underpins dozens of processes and tasks, particularly in today’s real-time tracking environment where using even slightly outdated data is impractical.

In the case of banks and financial institutions, data backup should occur at frequent intervals, ideally every few minutes. Automated tools support this seamless process without disrupting business operations. Employing both incremental backups—which capture only newly created or changed data every few minutes—and full backups every few hours helps eliminate the risk of data loss.

Finally, evaluate your offsite data storage. If a natural disaster takes out your building, you’ll be glad to have a backup server system at an alternate site in an unaffected location. Also, establish a backup power source and arrangements for recovery teams in case of situations where primary work locations are inaccessible.

6. Document the business continuity strategy

In this step of the BCP process, you’ll produce a written business continuity plan to disseminate across your organization. Based on the insights you’ve gained from your business impact and risk assessments, you should have a wealth of information to consolidate into a single document.

Within your disaster recovery plan, clearly define roles and responsibilities and contact information for key stakeholders/emergency team members. This action will ensure you’re ready to notify your people, especially if you have an intuitive employee notification system in place.

Preparing for worst-case scenarios is also a best practice that will help your business weather even unforeseen disasters. You should also have contingency plans in place for common problems:

- Key personnel are not available

- Facilities are inaccessible

- Equipment malfunctions

- Software is corrupted

- Service providers are unavailable

- Utilities (power/communications) are down

- Critical documentation is not available

A note of caution: If your business has more than one location, you’ll need to prepare for potential damage/disruption to multiple facilities.

The more you can plan for, the better you’ll be able to weather various disasters and maintain business continuity.

Watch this step-by-step video to learn how to create and optimize a plan that ensures your operations continue running smoothly—no matter what.

7. Share the plan

You don’t need to flood employees with information about your disaster response plan. Giving them too many details can overwhelm them. It can also make retention challenging, and they may not be prepared during an emotionally charged disaster. Focus on

- Communication: First and foremost, make sure employees know how to receive emergency messages and how to respond.

- Safety protocols: Clearly establish evacuation routes, fire drill procedures, and assembly points to get people to safety.

- Leadership: Employees should know who to go to in an emergency, whether that’s a team leader, supervisor, or designated safety captain.

- Critical tasks: Finally, notify anyone responsible for critical tasks during the stages of a crisis, making sure their roles are clear. Be sure to also notify people who are designated as backups in case the primary team members are unavailable.

Keeping it simple will allow your employees to retain this information during a disaster. Of course, all members of your safety team should have complete copies of the plan and should also participate in the next stage.

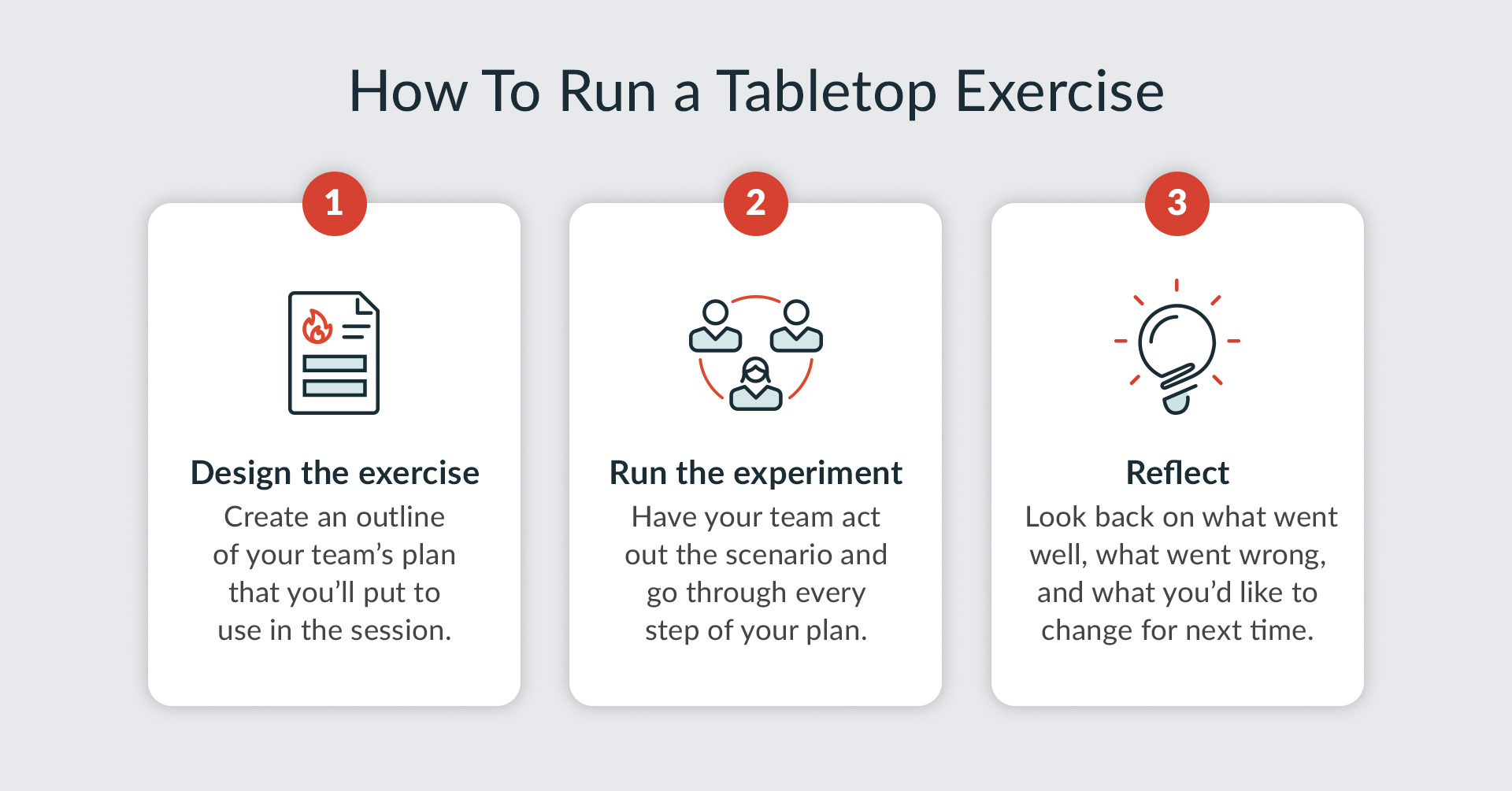

8. Complete informal testing

Test your business continuity plan at least once a year to ensure it covers all the bases and contingencies to avoid operational disruptions. But it’s a good idea to test segments of your plan more often with informal drills and tabletop exercises. You can conduct these exercises in a conference room or other low-stakes environment to have key parties “walk through” scenarios and test response plans. These exercises also serve as training to enhance preparedness.

The informal approach lets you test various disaster response plans without the disruption of a full-scale drill. Tabletop exercises are also a good opportunity to inject unexpected scenarios, so your team and your plan can adapt. Consider your geographic area and any risks related to your industry, and prioritize testing the disaster plans most likely to occur.

9. Conduct formal testing and drills

An emergency drill tests your business continuity plan in a realistic environment. Conducting one of these at least annually and involving all critical stakeholders will help you prepare for the unexpected and protect your business and staff.

The steps for running a full-scale drill are similar to those of a tabletop exercise, though they are more involved because you are conducting an actual simulation. A drill typically includes the following components:

Objectives

You will set goals to determine if your business continuity plan is successful. Some examples of goals might be achieving a 24-hour timeframe for resuming critical operations or maintaining customer satisfaction levels during a business disruption.

Participants

Every full-scale drill requires the involvement of all key stakeholders. These individuals will fit into one of four categories: facilitator, evaluator, observer, and participants.

Facilitator

The facilitator lays out the scenario and walks the parties through it. They go over the recovery time objectives and other goals and ask questions to keep things moving. | Evaluator

An evaluator monitors the drill’s progress and makes notes about both strengths and weaknesses in the response.

| Observer

Observers don’t directly participate in the event, but they may have dependencies with other directly involved departments. Common examples include HR or IT. | Participants

Most of your staff will fall into this category as they carry out tasks to support business resilience during a disaster.

|

Scenario

A realistic scenario starts the activity. The facilitator will introduce the scenario to the group, including details such as the type of disaster, its location, the extent of its impact, and the specific challenges it poses. It is designed to immerse participants in a lifelike situation, prompting them to respond as they would in a genuine disaster.

Debriefing

An informal debrief or hot wash may occur following the disaster drill to capture immediate impressions and insights. All of this information will be documented for the next part of your continuity planning strategy: the after-action review.

10. Complete an after-action review

An after-action review will allow all the stakeholders involved in your drill to share their impressions and gain feedback. This process is designed to answer four key questions:

- What were our goals?

- What were our results?

- What did we do well?

- What could we do better?

You should involve all key stakeholders in this review and encourage frank, open discussion about how the drill unfolded. It may be helpful to anonymize feedback opportunities, like through anonymous surveys, to make individuals more comfortable with sharing.

You can also use data from incident tracking software, communication logs, and participant feedback surveys to comprehensively understand the drill’s strengths and areas needing improvement. You can compile this information into an after-action report that you will use to document your findings and fix vulnerabilities.

11. Fix vulnerabilities

Once you complete your after-action review and report, decide how to act on any vulnerabilities in your BCP, prioritizing them based on their severity and potential impact. Then, you will develop strategies for mitigation. These strategies may include updating or revising plan elements, investing in technology or infrastructure improvements, enhancing staff training, or refining a crisis management plan.

This is an ongoing, continuous process. The threats to your business will change, and you’ll need to regularly assess their impact, kicking off the business continuity planning process all over again.

12. Share your results

Finally, share your results and celebrate your wins with your team. Much like sharing the plan, you don’t have to give them all the details. Hit the high points and discuss areas of concern.

You will also want to have internal reviews with key parties to provide an opportunity for feedback, learning, and continuous improvement. This collaborative approach fosters a culture of resilience. Everyone understands their role and actively safeguards the business during challenging times.

Financial firms face unique challenges when it comes to business continuity and disaster recovery. Regulations such as DORA (Digital Operational Resilience Act) help strengthen operational resilience in the financial services sector. BCP in banking is your method of managing security threats, compliance requirements, and potentially catastrophic economic loss. Of course, maintaining business continuity isn’t just about recovering technology and assets. Above all, it’s about keeping your people safe, informed, and connected.