Introducing Situation Reports: Your Single Source of Truth for Critical Events

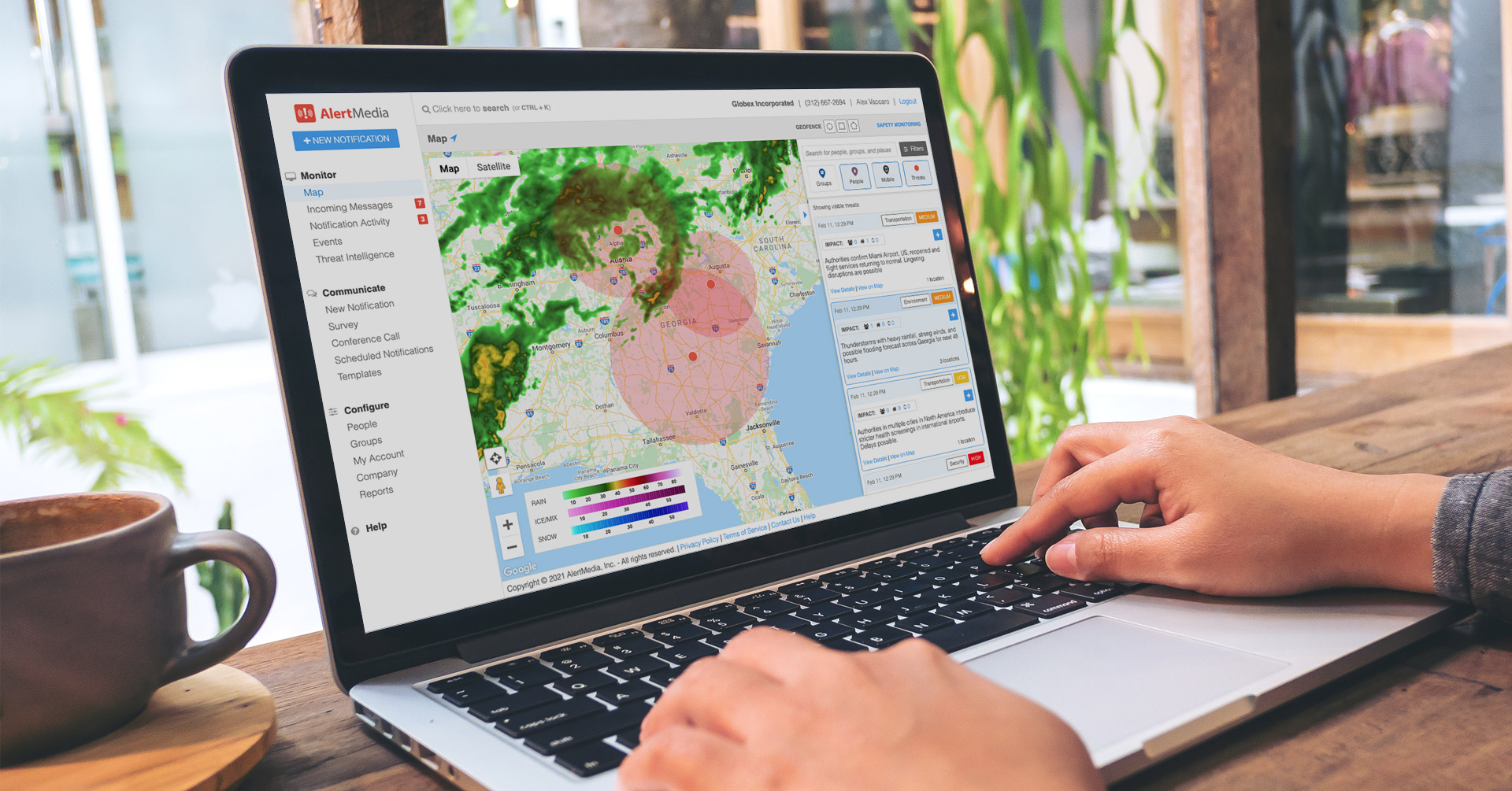

Monitor and respond to ongoing, wide-scale emergencies with expert-curated, comprehensive analysis.

Today’s rapidly evolving threat landscape often leaves security and business continuity professionals navigating information overload, piecing together intelligence from a wide range of sources. For fast-moving, dynamic events, this can make it challenging to keep track of what’s happening and harder still to know the impact on the broader organization.

In the case of broad-scale events, even a localized incident can have rippling impacts beyond the limits of the threat radius. For instance, wildfires result in air quality impacts far beyond the perimeter of the fire, and situations such as the Suez Canal blockage disrupt supply chains across the globe. It’s critical that businesses can see the full picture of an incident as quickly as possible.

For those reasons, we’re excited to release Situation Reports—the latest addition to our Threat Intelligence solution.

With Situation Reports, security and business continuity teams can now access accurate, dynamic, and unbiased intelligence on demand. This reduces the time required to conduct impact assessments and coordinate response efforts during large-scale events with significant business impact.

Timely, Reliable, and Comprehensive Analysis for an Effective Emergency Response

When a critical event occurs, time is your most valuable resource—and often, there isn’t enough of it. When you are responsible for the safety of your people and the ongoing operation of your business during a crisis, it’s imperative to make the most of what little time and bandwidth you do have. Researching critical events is time-consuming, and vetting that information to ensure it’s the most accurate is even more so. And when the situation details shift as the event goes on, even large SOC teams may struggle to keep up while juggling their other responsibilities.

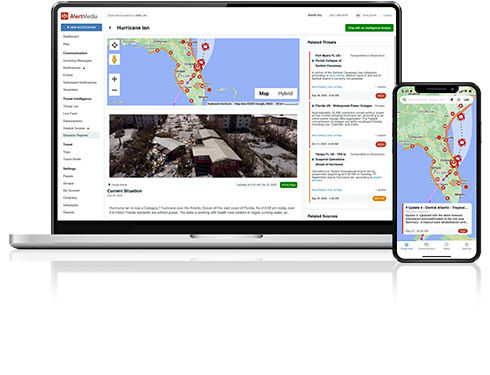

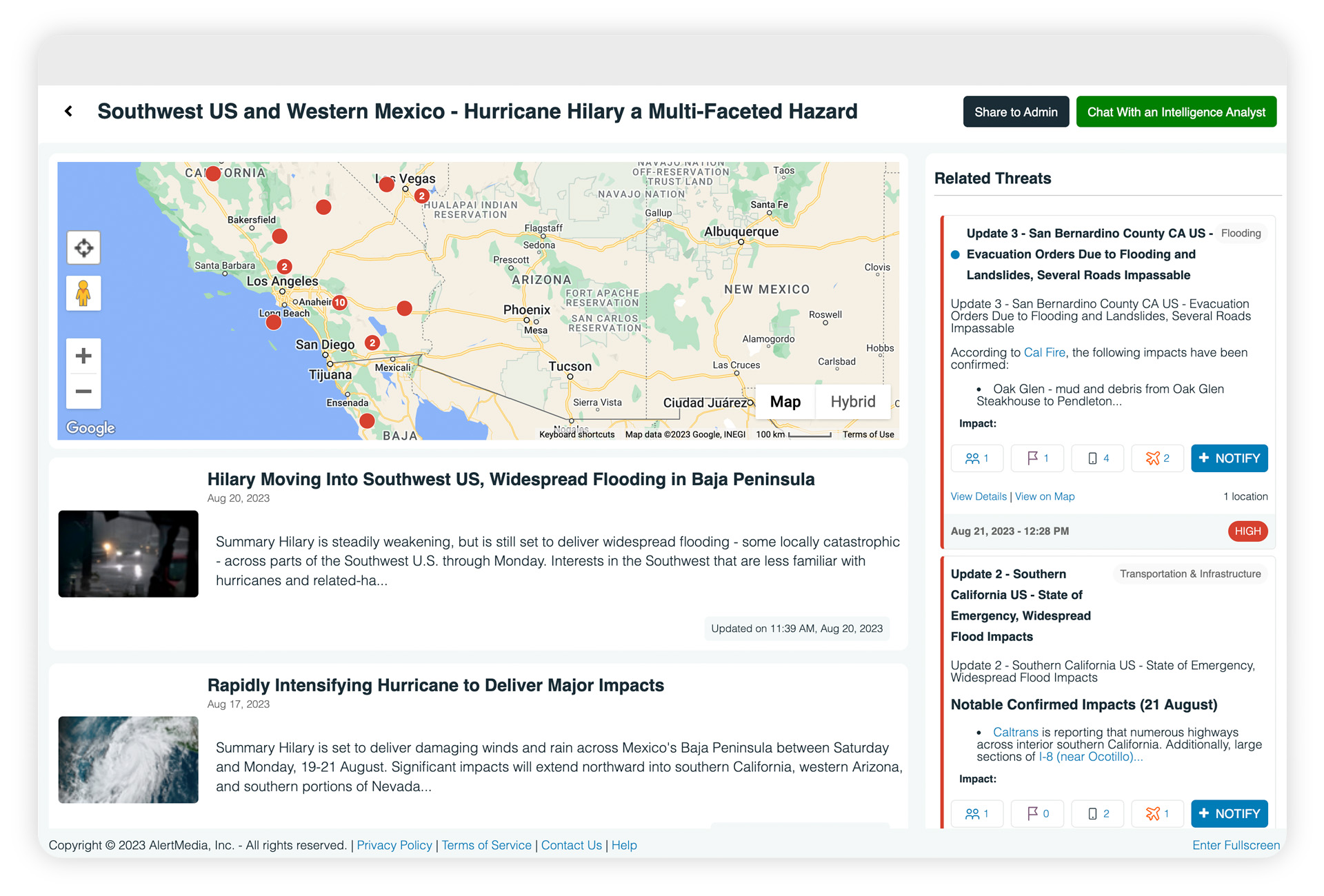

With Situation Reports, you’ll have a deep analysis of ongoing events all in one place, curated by experts—and you won’t need to research it all yourself. Each Situation Report will break down the events of the incident, the potential impacts, and the outlook going forward. You’ll also be able to see threats related to the event with the impact report of who at your company may be affected.

Here are some of the ways Situation Reports will help you monitor and respond to ongoing threat events:

- Save time monitoring broad-scale events

- We’ve consolidated all the information you need to understand the critical event. That way, you can focus your time and effort on your actual response. Our reports contain detailed analysis and information that’s easy to access in one place.

- Get clear, unbiased information you can trust

- We provide details verified by our expert analysts and include links to any related sources so you can rest assured you have the most accurate information available when it matters.

- Make better decisions to improve your emergency response

- You’ll know the full scope of impact from an emergency, with a view of active and historic threats alongside the report. With a complete picture of who and what is impacted by the event, you’ll have all the details to respond with confidence.

- Become the internal expert on unfolding events

- You’ll have all the information you need to coordinate and prioritize response efforts at your organization. You’ll also be able to report on the event more easily to stakeholders and leadership within your organization by simply passing along the pre-built report.

How Situation Reports Can Help Your Organization

The key to effectively protecting employees and business continuity is knowing important details about what’s going on. For major events, these details can shift and change fast, especially for ongoing incidents, and tracking down up-to-date information can be time- and labor-intensive. But Situation Reports make that process much more manageable.

“Situation Reports give our customers the ability to go deeper on major kinetic, ongoing, and planned events by bringing together more and richer information on the event in one place,” said Sara Pratley, Senior Vice President of Global Intelligence at AlertMedia. “We wanted to provide a centralized location with active alerts, more in-depth reporting and analysis, links to helpful resources, and more.”

Our team of expert threat analysts creates Situation Reports for events that have:

- Long-lasting impacts—Events with lingering effects, such as supply chain disruptions from a strike or environmental damage from a pipeline burst.

- Wide-spread impact zones outside the event area—Situations such as air quality hazards from fires or demonstrations spread throughout a whole region.

- Complex impacts that require additional analysis—Events with lots of contributing factors or complicated business continuity impacts that need in-depth explanation, such as the War in Ukraine.

Complex emergencies require equally complex analysis to ensure all potential impacts are accounted for. With Situation Reports, you’ll have a one-stop shop for all the details and analysis about these dynamic events.

See Situation Reports in Action

The right intelligence can make or break your business’s response effectiveness. Situation Reports are the best channel to get clear information about complex critical events without spending hours digging through news reports. And you’ll have an easy way to distribute internal event reports to stakeholders in your company. Schedule a demo to see Situation Reports in action and learn more about how they can benefit you.

More Articles You May Be Interested In

-

Company NewsAnnouncing Threat History: Better Insight on Past Events to Anticipate and Prepare for Future Risks

Company NewsAnnouncing Threat History: Better Insight on Past Events to Anticipate and Prepare for Future Risks -

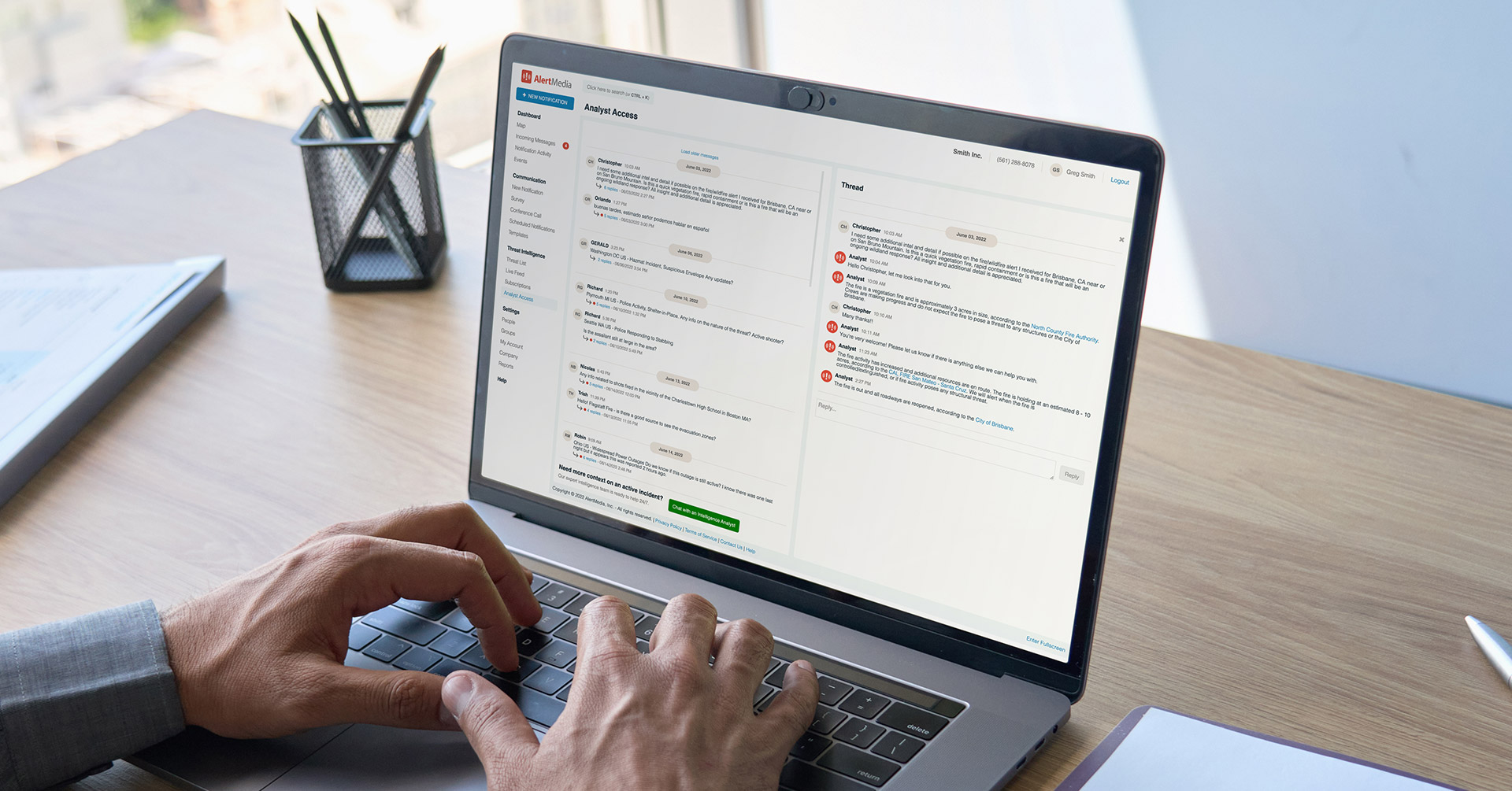

Company NewsIntroducing Analyst Access: Real-Time Insights on Emerging Threats

Company NewsIntroducing Analyst Access: Real-Time Insights on Emerging Threats -

Company NewsGlobal Threat Intelligence: Faster, Comprehensive, and More Relevant Information to Keep Your Employees Safe

Company NewsGlobal Threat Intelligence: Faster, Comprehensive, and More Relevant Information to Keep Your Employees Safe